The role that consumer savings play in the broader economy

After many years of having a negative savings rate where South Africans were spending more than they earned, the household savings rate was positive in the first quarter of 2018 at 1.3%, according to the June 2018 Quarterly Bulletin from the South African Reserve Bank. However, it was marginally down from 1.5% in the fourth quarter of 2017.

The June 2018 SARB Quarterly Bulletin, shows that the ratio of household debt to nominal disposable income inched higher to 71.7% in the first quarter of 2018 from 71.2% in the preceding quarter.

This means that although South Africans are finally starting to save, they are still dependent on credit to a large degree. Chairperson of the South African Savings Institute, Prem Govender says young South Africans are increasingly relying on credit to provide for basic needs. “Financial literacy education from an early age is vital to counteract this trend,” she says.

Pocketbook choices affect the economy

The harsh reality is that savings are a key cog in the economic wheel. Although saving plays an important role for an individual who is trying to achieve financial goals, it also ties into the health of the national economy. The national savings rate includes individual savings as well as corporate savings and public sector saving.

American economist, Frederic Mishkin, speaking at the Third National Summit on Economic and Financial Literacy in Washington, pointed out that the individual citizens of a country make a number of pocketbook decisions every day that have an impact on the health of the economy. These include regular choices such as whether to take on a particular mortgage, how much to save and invest, whether to lease or buy a car, and how to manage credit cards. "This brings us back to the importance of financial literacy. The choices we make as individuals, as consumers and investors, are linked to the broader economy in ways that we don't always appreciate. However, one thing is certain. We make better decisions if we are better informed, and the whole economy benefits. That's the promise of economic education… that it not only improves the lives of individual consumers, but that it also makes for more effective policy and a better economy," he said.

The knock-on effect of a higher national savings ratio

When the public sector has succeeded in saving money, this is also known as a government budget surplus. Unfortunately, South Africa is currently running a budget deficit, which is why it is so important to encourage and foster a savings culture among South Africans.

A higher national savings ratio is more likely to encourage foreign investment in a country and this then leads to faster economic growth. The knock-on effect of faster economic growth is job creation. A poor national savings rate, on the other hand, leads to a low level of investment, leading to weak economic growth, lower job creation and higher dependency ratios, and ultimately even less saving and investment.

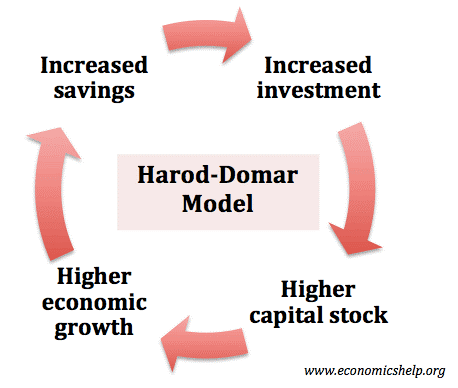

The Harrod-Domar model of economic growth suggests the level of savings is a key factor in determining economic growth rates.

Sources:

- South African Reserve Bank

- South African Savings Institute

- Economicshelp.org

- Fin24: https://www.fin24.com/Savings/News/what-saving-means-for-the-economy-20160705;

- Governor Frederic Mishkin, The Importance of Economic Education and Financial Literacy – speech made at the Third National Summit on Economic and Financial Literacy, Washington, D.C https://www.bis.org/review/r080305f.pdf

Disclaimer

This article is meant for information purposes only and should not be taken as financial advice. For tailored financial advice, please contact your financial adviser.

Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider.