What affects investment returns?

When markets become volatile, it is quite common for investors to become spooked and start worrying about whether their investment strategy needs to be revisited.

Your clients may have some concerns, particularly in light of the current investment climate. The JSE All Share Index gained 0.3% from the start of the year to end August 2018. Over the same period, the All Bond Index returned 4.5%, SA Cash gained 4.8% and listed property fell by a whopping 20.1%1.

This tells you that no matter which company your clients invested with or which fund they invested in, low returns are currently being seen across all asset classes. However, in addition to the current economic environment, there are other factors that affect the final return figure on an investment statement.

1. The effect of an investment contribution method on returns

Clients can choose to invest in one of two ways – either through a lump-sum investment or recurring monthly contributions.

Lump-sum investments: An example of a lump-sum investment would be if a client invested a single amount into a unit trust fund. When growth is calculated on this investment, it is calculated based on the single lump-sum amount.

Recurring contributions: If a client invests through recurring contributions, for example, a debit order of R500 a month, they will experience a different return profile. Because contributions are invested at different times, the growth on each contribution will accumulate at different rates. This is due to the fact that markets are unpredictable in the short term.

Additional actions that affect the overall return of both lump–sum and recurring investments include the following:

- Additional contributions: Since the size and the timing of an additional contribution might be different to the initial or monthly investments, the growth on additional contributions will be different in rand terms. The overall return will be affected more by larger contributions that have been invested for longer.

- Partial withdrawals: If a client withdraws from their investment, they will miss out on future returns.

- Switches: Switching between different funds will have an impact on the investment return as different funds grow at different rates.

2. The effect of an investment’s timing

A big factor that comes into play here is timing. When did the client invest in a particular fund or enter the market? A fund factsheet typically shows returns from 1 January to 31 December.

Many investors incorrectly believe that if a fund factsheet depicts a 12% annualised return, they would have received approximately 1% per month over the year, ignoring compound interest.

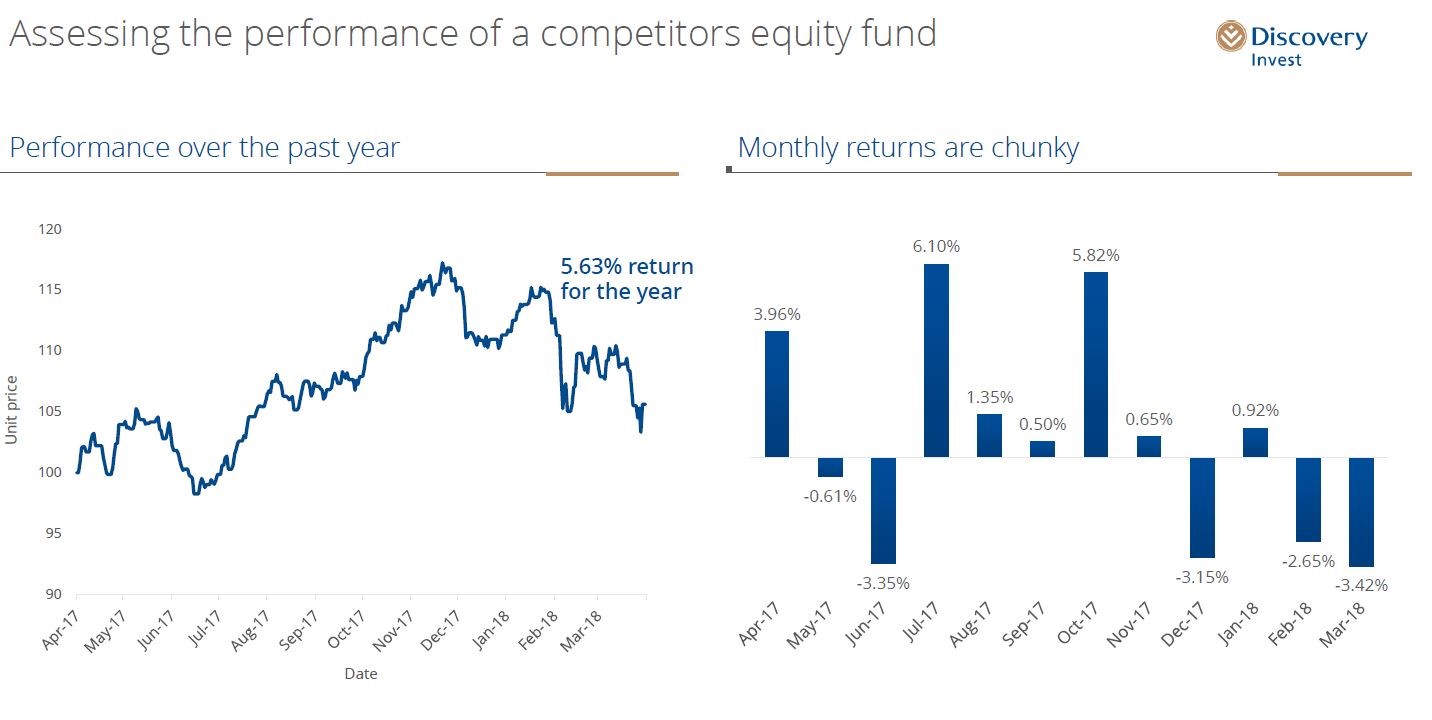

Besides fees and commissions, which detract from investment returns, it is important to point out that the way a unit trust fund accumulates returns over time is not necessarily linear. Investment returns are chunky and can be both positive and negative over any investment period, in this case, a year.

Source: Morningstar as at 31 March 2018

Take the above, an example of a well-known asset manager’s equity fund. The first chart shows the average annualised return of the fund over a year, while the bar graph shows the way in which the fund generated its return over the same period, month by month.

It is easy to see that the returns earned over the period was 5.63%, and that is shown on their fund factsheet as represented by the first graph. However, if you look at the distribution of returns over time, these were not earned equally.

For example, the return for June 2017 was a negative 3.35% and a month later in July it was 6.1%. But if you average it out over the full period from April 2017 to March 2018, you get an average annualised return of 5.63%.

3. The effect of fees on an investment

A difference of just 1% in fees can have a big impact on clients’ savings. They need to read their statement carefully to ensure they understand the charges and speak to you, their financial adviser, if they have any questions.

In 2016, the Association for Savings and Investment South Africa (ASISA) introduced Effective Annual Costs (EAC), which was designed to allow investors to easily compare fees on two competitive products. The four cost disclosures that must be shown are:

Investment management charges: These include the charges of any wrap product, such as a fund of funds, and those of the underlying funds, as well as things such as stock broker charges and VAT.

Advice charges: If Discovery pays commissions or fees to you on the client’s behalf, these fees must all be disclosed. This includes all initial and annual fees on both lump-sum and recurring-contribution products.

Administration charges: All charges relating to the administration of the product must be disclosed.

Other charges: This includes all remaining charges, such as termination charges, loyalty bonuses, guarantees, smoothing or risk benefits, and charges for risk benefits such as a premium-waiver benefit. These charges must all be explained in notes published directly under the EAC table of costs.

Each of the four components must be calculated and disclosed separately and then totalled to provide one EAC figure for the financial product, expressed as a percentage of the investment.

These factors affect an investment’s internal rate of return

An investment’s internal rate of return is the annualised rate of return the investment portfolio has produced. This rate includes all costs and tax already paid.

When a client looks at their investment statement, the internal rate of return figure is arrived at once all the above factors have been taken into account, as well as any transactions that might affect this rate.

The solution is to stay focused and stick with an investment strategy

History shows us that over the long term, an investment is likely to show an upward trajectory, ironing out the dips that may have occurred along the way.

The key is that clients have to remain impartial to short-term movements (under one to two years) and stay focused on their long-term investment objectives (five to 40 years). They should avoid emotional investment decisions as this ends up destroying the value of an investment in the long term.

Why Discovery Invest should be your partner of choice

Despite the current difficult economic environment:

- The Discovery Balanced Fund had a return of 9.07% for the year to end August 2018 against a benchmark return of 3.80%2

- The Discovery Diversified Income Fund had a return of 8.47% for the year to end August 2018 against a benchmark return of 7.29%2

- Our flagship fund, the Discovery Balanced Fund, was the 7th biggest flow taker in the industry, with net flows of R989 million for the second quarter of 2018, making it the 12th biggest retail fund out of more than 1 000 funds in the country (excluding money market funds), as per ASISA (www.asisa.co.za)3

- The Plexcrown Survey for quarter two 2018 shows Discovery Invest retaining a place among the top five asset managers in the country4.

- 1Returns sourced from Bloomberg for period from 1 January 2018 to end August 2018.

- 2Returns from Profile Data to the end of August 2018

- 3https://www.asisa.org.za/media-release/local-cis-industry-grows-investor-assets-to-r2-3-trillion/

- 4Plexcrown Survey for quarter two 2018: http://www.plexcrown.co.za

- https://www.thebalance.com/rolling-returns-versus-average-annual-returns-2388654

- https://www.iol.co.za/personal-finance/new-cost-standard-for-investments-1983997

- https://www.fanews.co.za/article/investments/8/general/1133/rand-cost-averaging-proves-its-worth-in-declining-markets/6729

Disclaimer

Nothing contained herein should be construed as financial advice and is meant for information purposes only. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider.

What to know before investing in collective investment schemes (unit trusts)

Before you invest in a collective investment scheme, there is important information you should know. This includes how we calculate the value of your investment, what affects the value of your investment, and investment charges you may have to pay. This notice sets out the information in detail. Speak to your financial adviser if you have any questions about this information or about your investment.

What the investment is

This Fund is a Collective Investment Scheme (also known as a unit trust fund) regulated by the Collective Investment Schemes Control Act, 45 of 2002 (CISCA). Collective investment schemes in securities are generally medium- to long-term investments (around three to five years).

Who manages the investment?

Discovery Life Collective Investments (Pty) Ltd, branded as Discovery Invest, is the manager of the Fund. Discovery Invest is a member of the Association of Savings and Investment South Africa (ASISA).

You decide about the suitability of this investment for your needs

By investing in this Fund, you confirm that:

- We did not provide you with any financial and investment advice about this investment

- You have taken particular care to consider whether this investment is suitable for your own needs, personal investment objectives and financial situation.

You understand that your investment may go up or down

1. The value of units (known as participatory interests) may go down as well as up.

2. Past performance is not necessarily an indication of future performance.

3. Exchange rates may fluctuate, causing the value of investments with international exposure to go up or down.

4. The capital value and investment returns of your portfolio may go up or down. We do not provide any guarantees about the capital or the returns of a portfolio.

How we calculate the unit prices and value the portfolios

1. We calculate unit trust prices on a net-asset value basis. (The net asset value is defined as the total market value of all assets in the unit portfolio, including any income accrued and less any allowable deductions from the portfolio, divided by the number of units in issue.)

2. The securities in collective investment schemes are traded at ruling prices using forward pricing. (Forward pricing means pricing all buy and sell orders of units according to the next net-asset value).

3. We value all portfolios every business day at 16:00, except on the last business day of the month when we value the portfolios at 17:00.

4. For the money market portfolio, the price of each unit is aimed at a constant value. This means that all returns are provided in the form of a distribution and that a change in the capital value will be an exception and only due to abnormal losses.

5. Buy and sell orders will receive the same price for that day if we receive them before 11:00 for the money market portfolio and before 14:00for the other portfolios.

6. We publish fund prices every business day, with a three-day lag, on www.discovery.co.za

About managing the portfolio

1. The portfolio manager may borrow up to 10% of the portfolio's market value from any appropriate financial institution in order to bridge insufficient liquidity.

2. The portfolio manager can borrow and lend scrip.

3. The portfolio may be closed in order to be managed according to the mandate (if applicable).

Fees and charges for this investment

There are fees and other charges for this investment.

The fees and charges that apply to this investment are included in the net asset value of the units and you do not have to pay any extra amounts. These fees and charges may include:

- The initial fund management fee

- Commission

- Incentives (if applicable)

- Brokerage fees

- Market securities tax

- Auditor fees

- Bank charges

- Trustee fees

- Custodian fees

You can ask us for a schedule of fees, charges and maximum commissions.

The total expense ratio

- “Total Expense Ratio” means a measure of a portfolio's assets that have been expended as payment for services rendered in the management of the portfolio or collective investment scheme, expressed as a percentage of the average daily value of the portfolio or collective investment scheme calculated over a period of a financial year by the manager of the portfolio or collective investment scheme.

- A percentage of the net asset value of the portfolio is for fees and other charges relating to managing the portfolio. The percentage is referred to as the total expense ratio (TER).

- A higher TER does not necessarily imply poor return, nor does a low TER imply good return.

- The current TER is not an indication of any future TERs. If fees go up, the TER is also expected to increase.

- During any phase-in period, the TERs do not include information gathered over a full year.

Transaction costs (TC)

1. Investors and advisers can use transaction cost (TC) as a measure to work out the costs they will incur in buying and selling the underlying assets of a portfolio.

2. The transaction cost is expressed as a percentage of the daily net asset value of the portfolio calculated over three years on an annualised basis. (This means the amount of interest an investment earns each year on average over three years, expressed as a percentage.)

3. Transaction cost is a necessary costs in administering the Fund. It affects the Fund's returns. It should not be considered in isolation as returns may also be affected by many other factors over time, including:

- Market returns

- The type of fund

- The investment decisions of the investment manager

- The TER.

4. Where a fund is less than one year old, the TER and transaction cost cannot be calculated accurately. This is because:

- The life span of the fund is short

- Calculations are based on actual data where possible and best estimates where actual data is not available.

5. The TER and the TC shown on the fund sheet are the latest available figures.