Why do I need to preserve my retirement savings if I move jobs?

As tempting as it may be to take a cash payout from your retirement savings when you leave a job, it's smart to hold on to your savings. A preservation fund will help you stay on track to become financially independent in retirement and achieve the retirement you aspire to.

Moving to another job? Recently retrenched? If you've been contributing to a pension or provident fund and need somewhere to keep those savings safe until you retire, you can use a preservation fund. Here's a quick look at preservation funds and why they're so important.

What is a preservation fund?

Pension and provident preservation funds are retirement funds specifically designed to receive lump-sum transfers from your employer's retirement fund if you leave your employer. Usually, you can also transfer your proceeds from one preservation fund to another depending on restrictions set by the South African Revenue Service (SARS) from time to time. This allows your retirement capital to stay invested and keep growing, without interruption.

Depending on how long you've been at a job, the amount of retirement savings you've built up can be a substantial amount. If you change jobs, you'll have to decide what to do with the proceeds of your investment.

Can I access my preservation funds before I retire?

Once you transfer your retirement savings into a preservation fund, there are limited withdrawals you can make until retirement, which means that you preserve your savings for retirement.

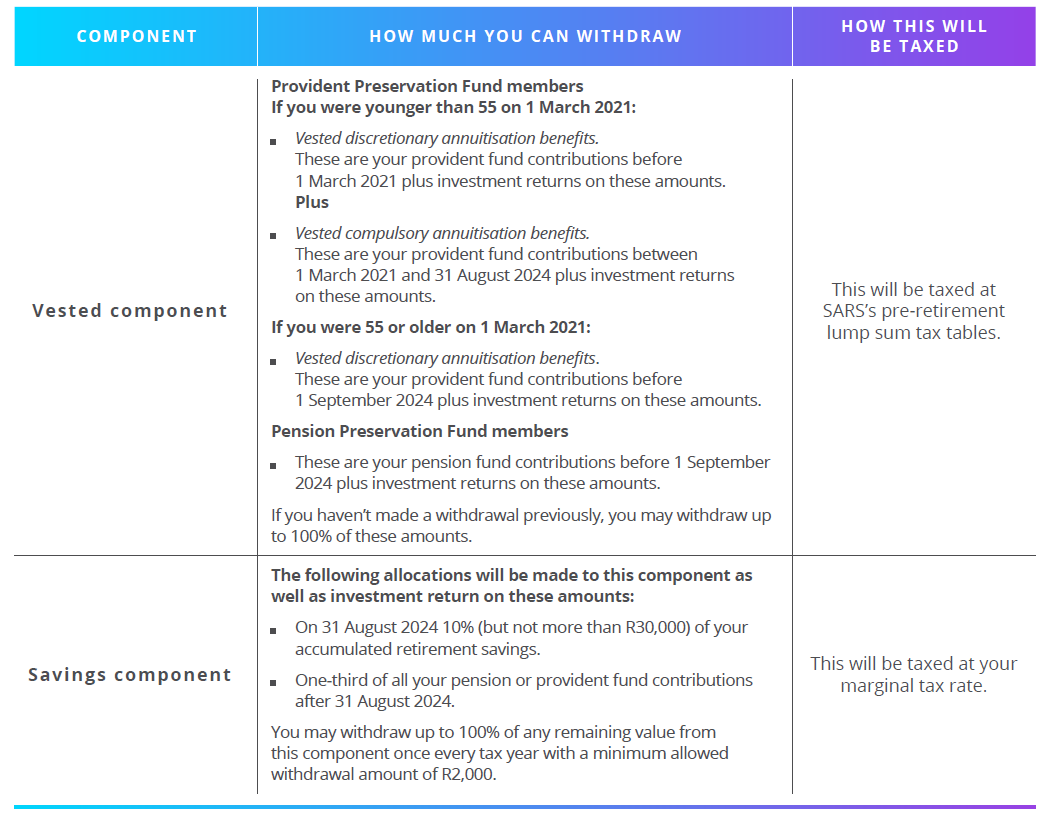

In terms of South African law, from 1 September 2024, the investment value of all preservation funds have been split into three components - vested component, savings component and retirement component. These components have different rules in terms of how much you can withdraw.

Before retirement, you may withdraw from the following components. Please note that early exit fees and admin fees may apply:

Why it's so important to preserve your funds instead of being paid out

The number of people choosing preservation are low, largely because people don't fully realise the long-term implications of their decisions. Not preserving is a major factor in people's inability to eventually retire comfortably.

This is because when you don't preserve your retirement savings, you effectively reset your retirement savings journey. The impact is huge because you won't be able to benefit from compound growth on the amount that you could've preserved (and if you understand how compounding works, you'll know that every year counts). In addition, the new contribution level you need to retire well will jump by a significant amount, depending on the time you have left to retirement.

Preserving is powerful because you can capture the full growth of 25 to 45 years of continuous investing, depending on when you start contributing to a retirement fund and for how long you work in total. Opting for a payout may mean that essentially, your retirement savings start from zero again. Those who choose to cash out may not realise their loss until much later, when they retire.

How do I access my funds once I retire?

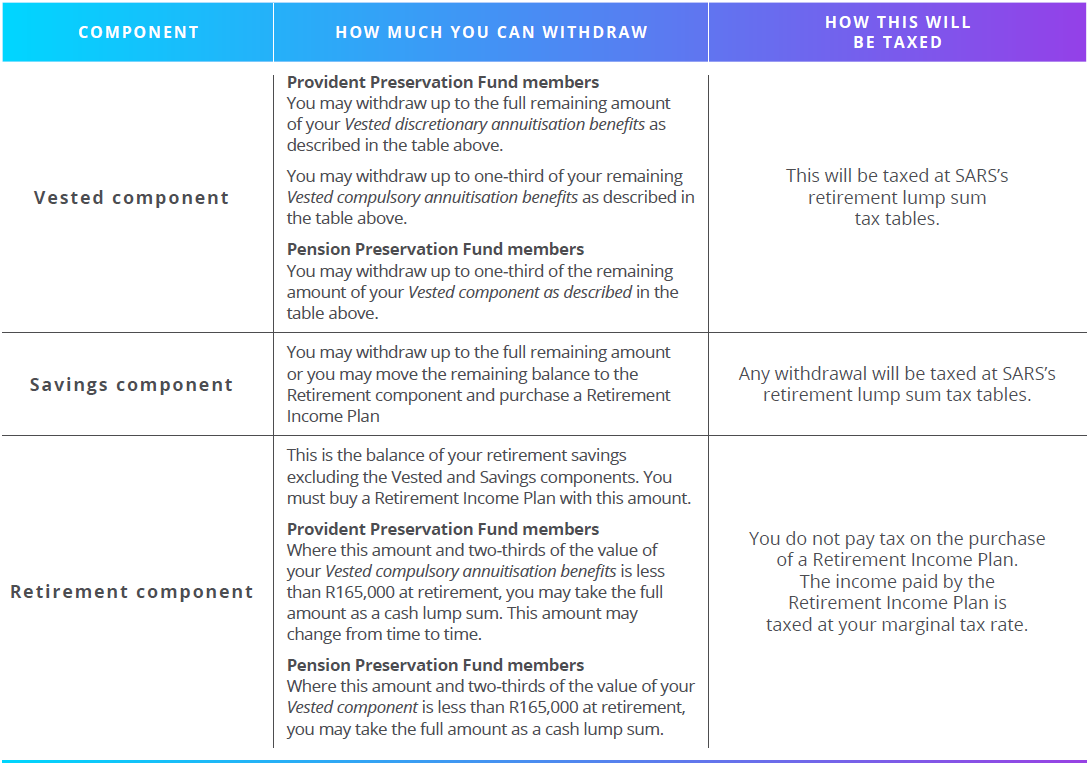

At retirement, you may withdraw from the following components:

Please note that the values in the table above may be updated from time to time in line with changes to legislation and tax practice.

This document is meant only as information and should not be taken as financial advice. For tailored financial advice, please contact your financial adviser. Discovery Life Investment Services Pty (Ltd): Registration number 2007/005969/07, branded as Discovery Invest, is an authorised financial services provider. All life assurance products are underwritten by Discovery Life Ltd. Registration number: 1966/003901/06, a licensed life insurer, an authorised financial services provider and registered credit provider, NCR registration number NCRCP3555. All boosts are offered through the insurer, Discovery Life Limited. The insurer reserves the right to review and change the qualifying requirements for boosts at any time. Product rules, terms and conditions apply.

Secure your financial future through our wide range of investments

We know that not everyone is at the same stage in their lives and everyone has their own reasons for investing. That's why we have designed products to meet your needs, whatever stage you're at. So, tell us about yourself so you can consider investments that are relevant to you.