To understand our business is to understand our WHY, HOW and WHAT

![]()

Our core purpose

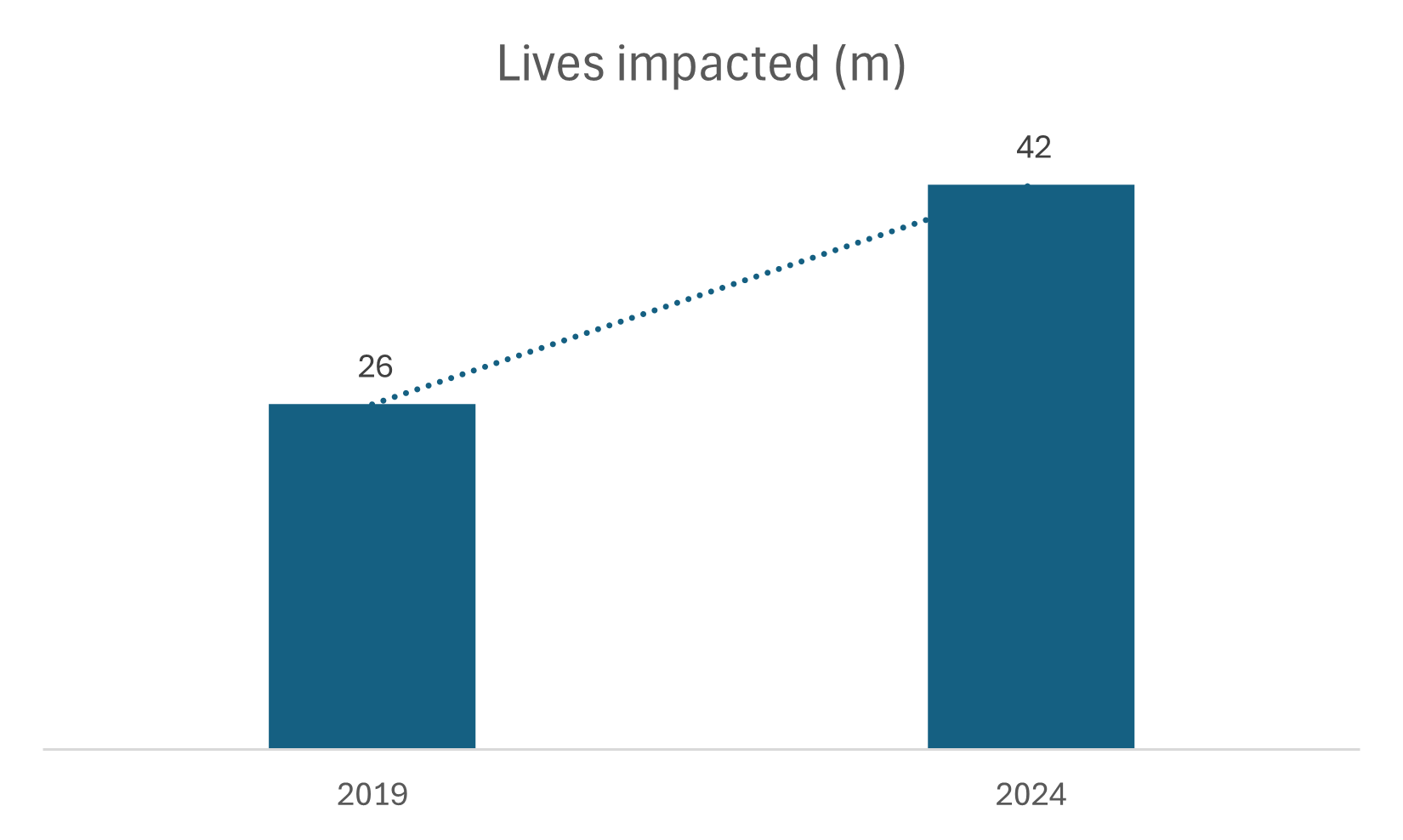

To make people healthier and enhance and protect their lives.

![]()

What sets us apart

Our three strategic business model strands of South Africa, the United Kingdom and Vitality Global - underpinned by our leading behaviour change platform, Vitality, and supported by our unique foundation and operating model

![]()

Our products and services

- Health insurance, administration and managed care of medical schemes

- Life insurance

- Banking

- Behaviour-change programmes

- Long-term savings and investments

- Short-term and personal insurance

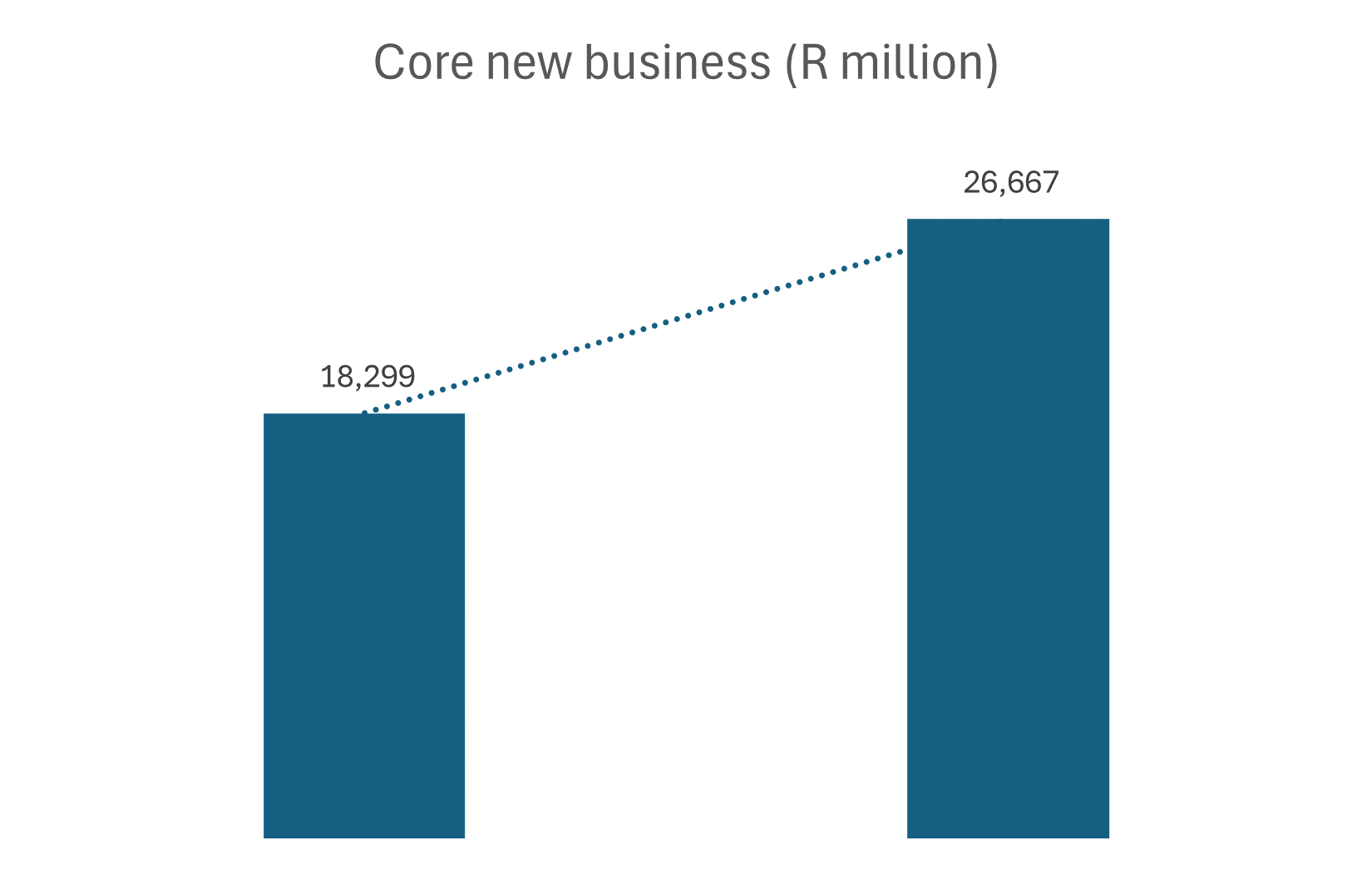

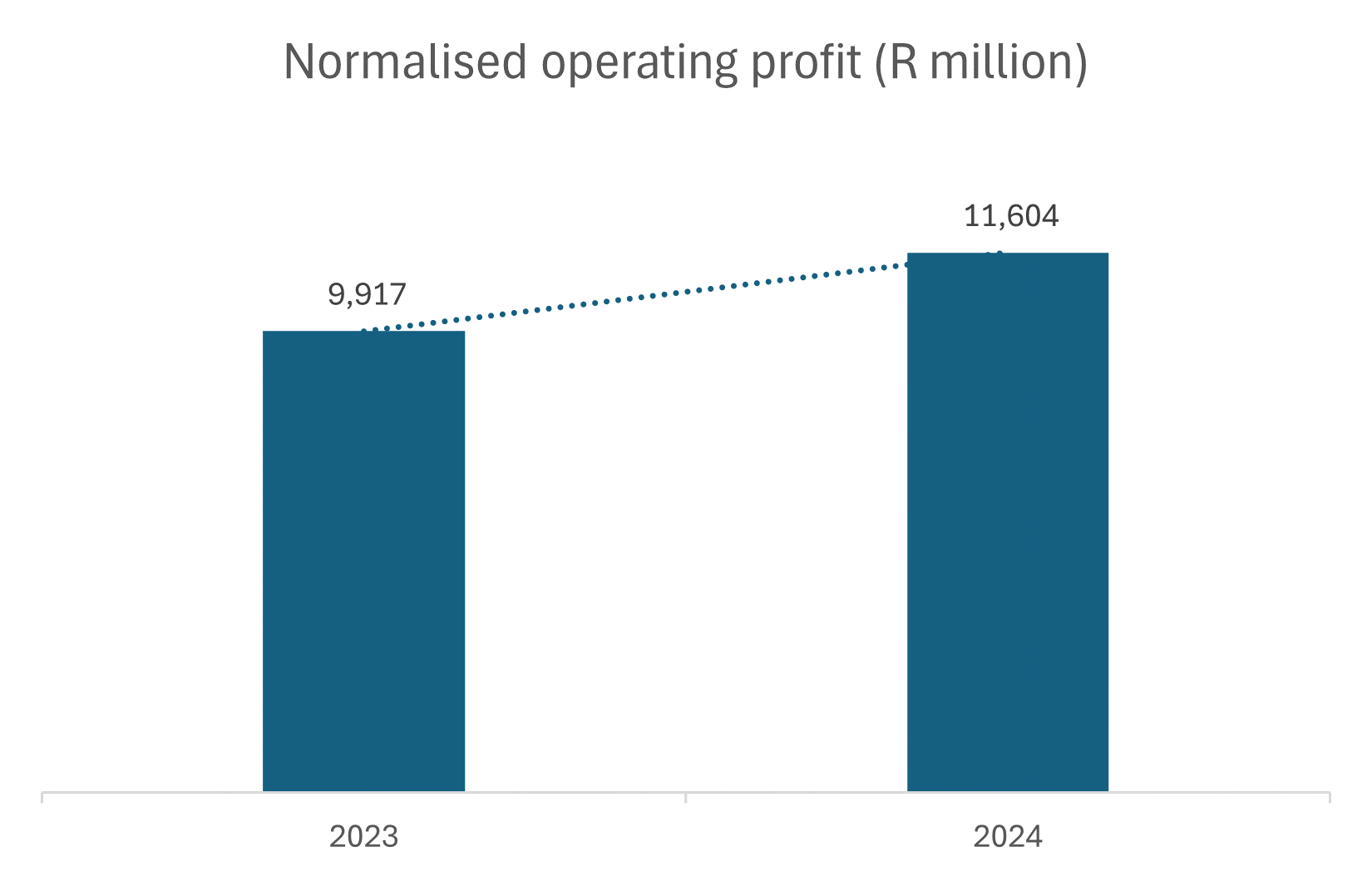

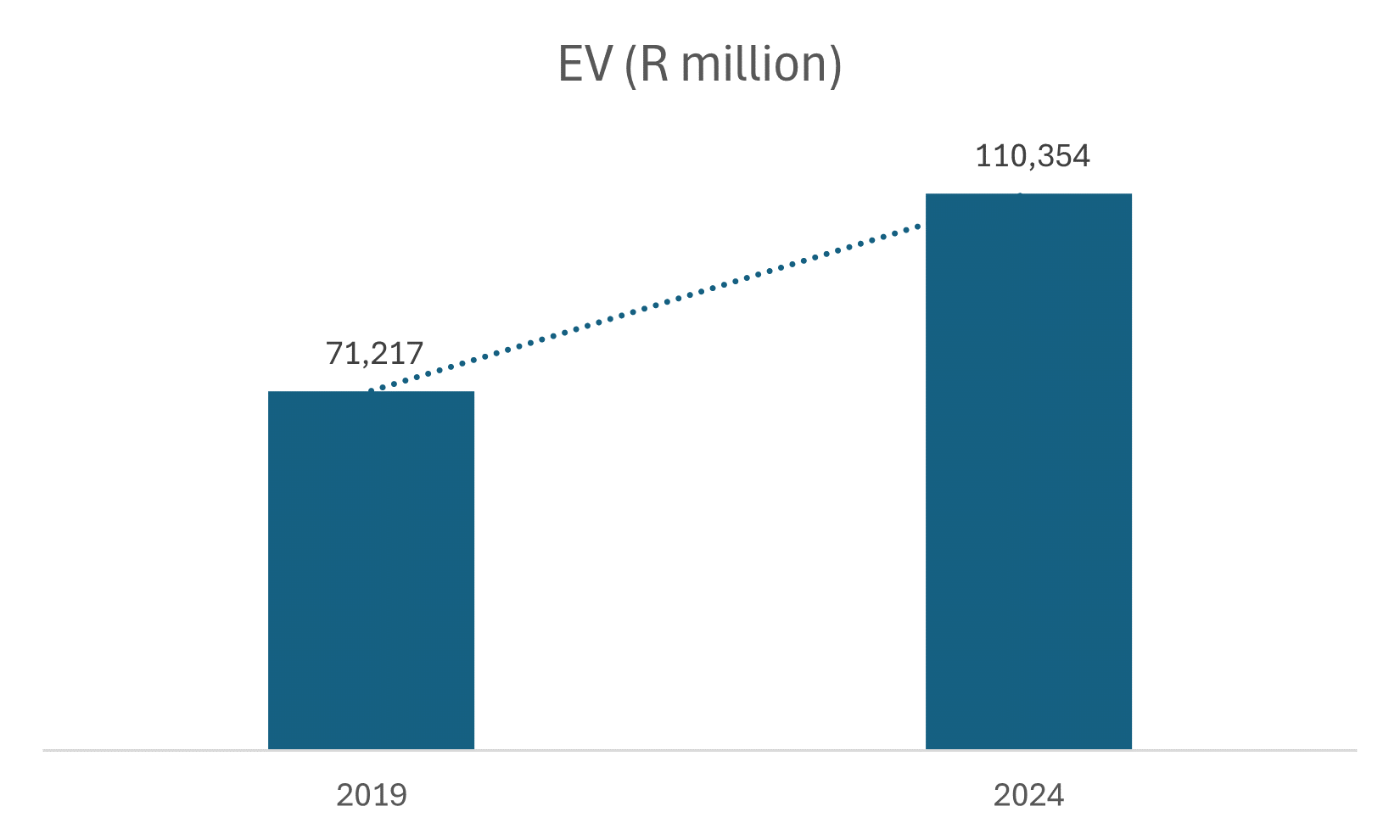

Our WHY, HOW and WHAT guides our long-term objectives across our three strategic business strands, which are scaled through our strategy and medium-term ambition statements - an approach that has transformed Discovery into the business it is today. To deliver on our core purpose and strategy to achieve certain ambition statements, we focus on three dimensions:

Building brilliant businesses

Strengthening our business foundation

Enhancing our financial and social impact

Nature of risk

Health and wellness are of increasing importance in determining both noncommunicable and communicable disease risk. With our Shared-value Insurance model, we are well placed to capitalise on this trend through our understanding of the behavioural nature of risks and the incentives that drive improved behaviour.

Technology

In the context of global lockdowns and physical distancing to help flatten the COVID-19 curve, there has been a rush to the online world. Online consultations, for example, are proving to be an effective and sustainable patient-care solution going forward.

Social Responsibility

There is a heightened demand for purpose-based business models, given the need to find profitable solutions to society's challenges. Our strong core purpose guides our actions to create and enable sustainable and meaningful change.

Robust long-term returns for our stakeholders

Our robust operating model has allowed us to deliver superior long-term value for our shareholders, and allows us to serve a large customer base spread across 40 countries.

Strong capital position

Business astuteness and prudence remains a core element of our values and we believe in providing the best value to all our stakeholders while ensuring robust financial soundness. Our capital philosophy ensures that each of our businesses are well capitalised as stand-alone entities. The Group provides additional coverage, remaining in excess of its internal targets, while our financial leverage ratio, at 20% in 2023, is well below the internally set guidance threshold of 28%.

ESG ratings

Being a responsible corporate citizen has been a fundamental component of our core purpose from the start. Our favourable ESG ratings are a manifestation of this reality.

A

as at September 2024

89%

as at September 2024

14.9

as at September 2024