SpendTrend: Black Friday Edition 2024

4 December 2024

Our clients made the most of their spending and savings during this exciting shopping event. Below is a summary of their spending behaviour and strategies to maximise value this past Black Friday.

Key insights on Black Friday shopping and payment methods

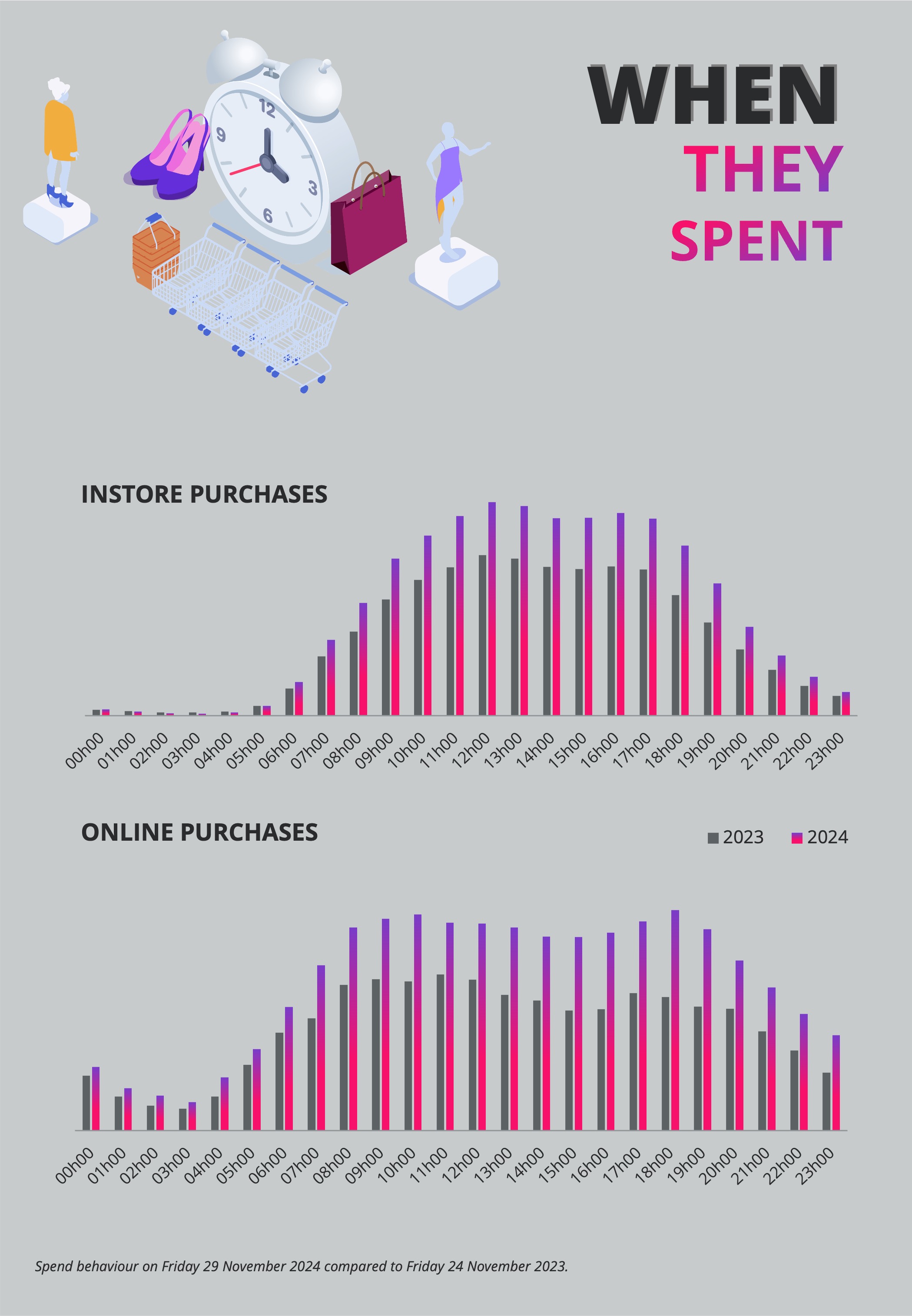

- Strong growth for Discovery Bank: Total card transactions rose 37% from 2023, with online purchases increasing by 46%. Compared to a typical last Friday of the month, total in-store spending increased by 50%, while total online spending surged by over 150%.

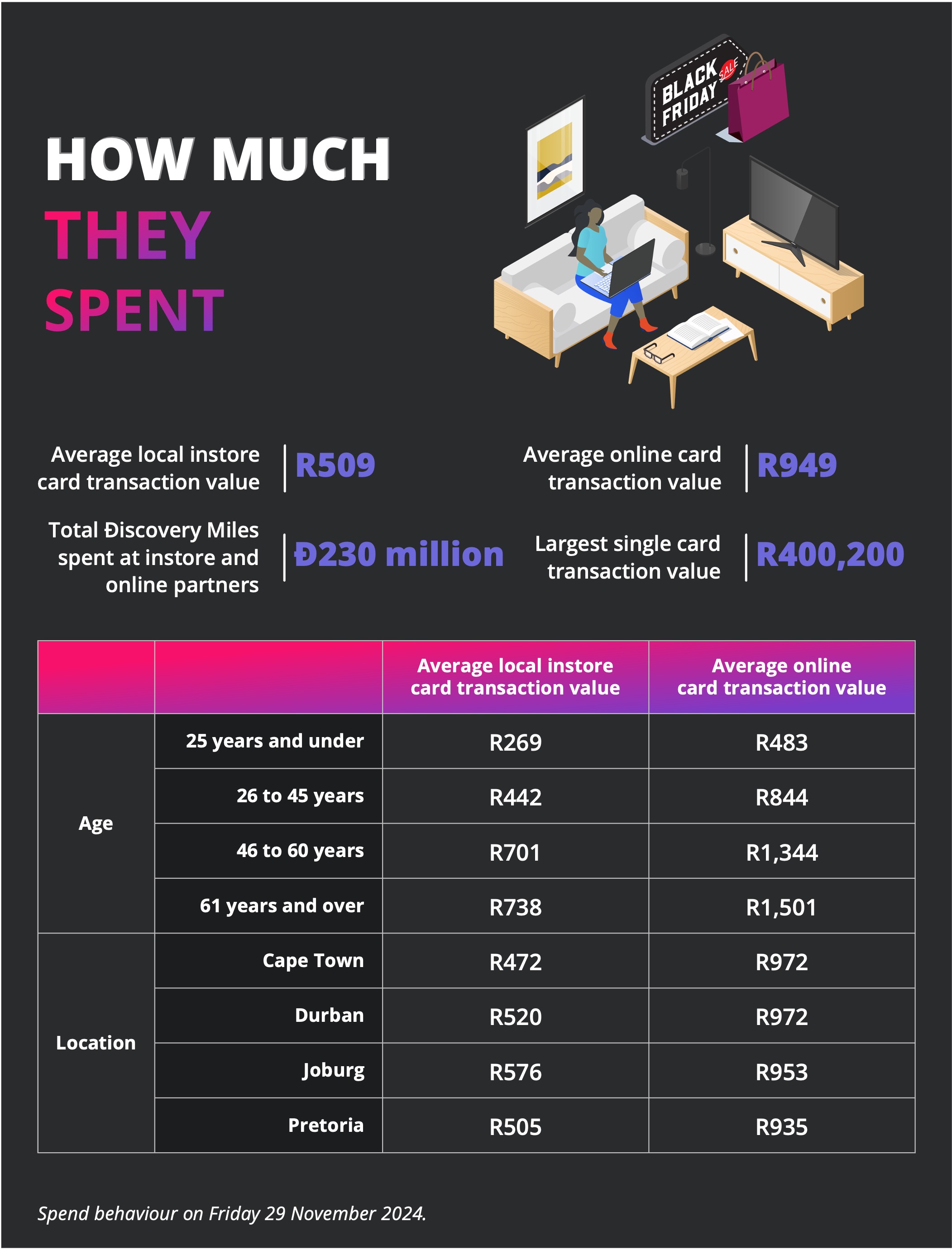

- Higher spend when online: The average online basket size (R949) was almost double that of instore (R509), showing a preference for big-ticket items online. Online share of total spend has increased slightly, now accounting for 30% of all purchases. Takealot dominated online sales, with international players like Temu and Shein experiencing strong growth.

- Increased use of digital payments: Smart device payments climbed to nearly 45% of in-store transactions (up from a third in 2023), with 60% adoption among under-25s and more than 65% growth among over-60s. Virtual card use doubled for both online and in-store, indicating increased awareness of its benefits, with clients embracing the increased security and convenience when transacting.

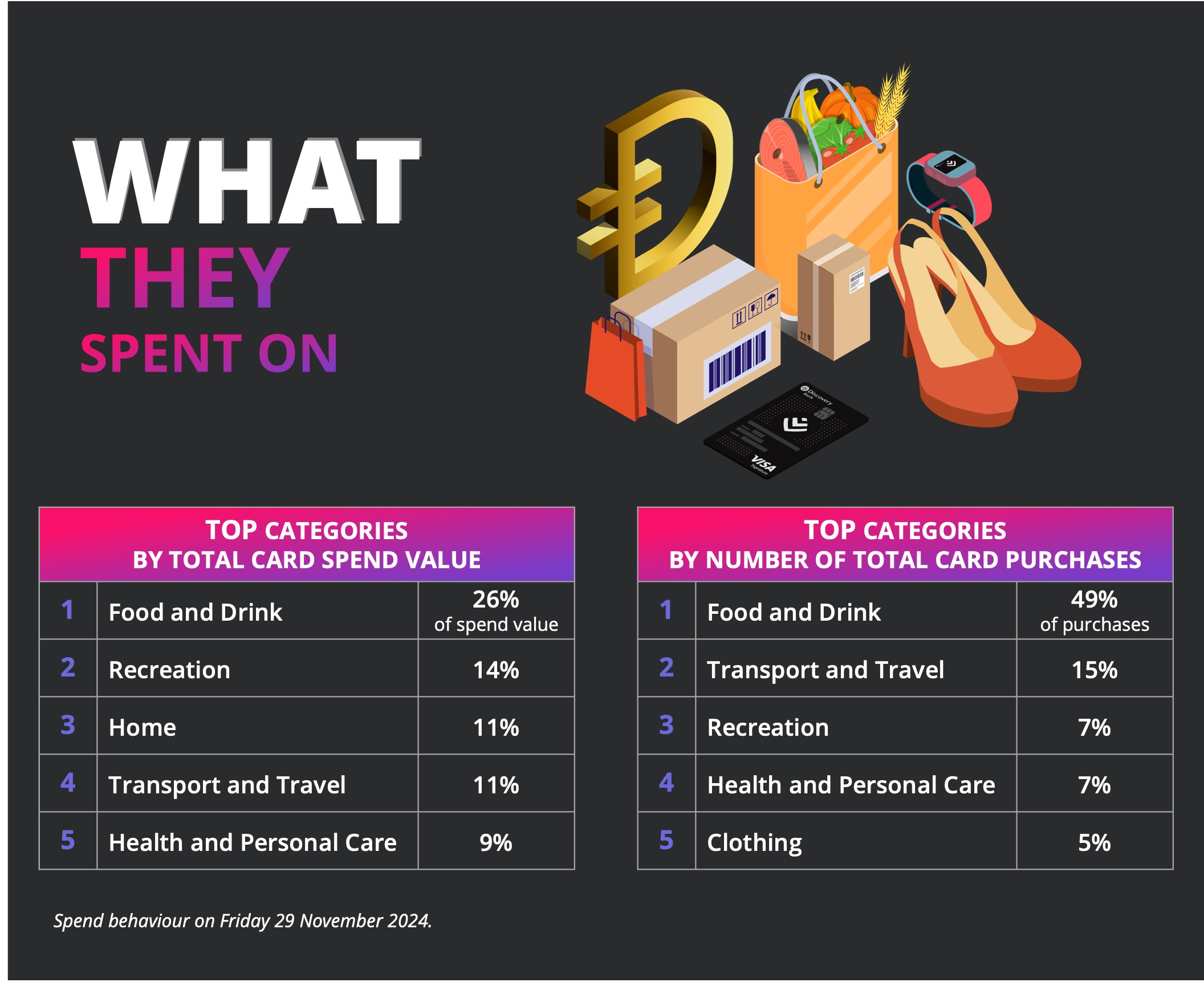

- Spend focus on essentials and home items: Food and drink, recreation, and home goods dominated Black Friday spend. However, clothing ranked as a top three spend category amongst under-25s. Growth in online spending on appliances, electronics, home, and clothing outpaced instore growth.

- Significant Ðiscovery Miles savings: Clients redeemed nearly 230 million Ðiscovery Miles (+50% from 2023), with a total redemption value of more than R30 million. Spending was 30% higher than the average monthly Miles Ð-Day activity, as clients enjoyed additional Ðiscovery Miles savings along with Black Friday discounts.

Black Friday SpendTrend Dashboard