Credit reimagined

Digitally control your credit through your financial behaviours and the Discovery Bank app.

That's the Future of Banking. Now.

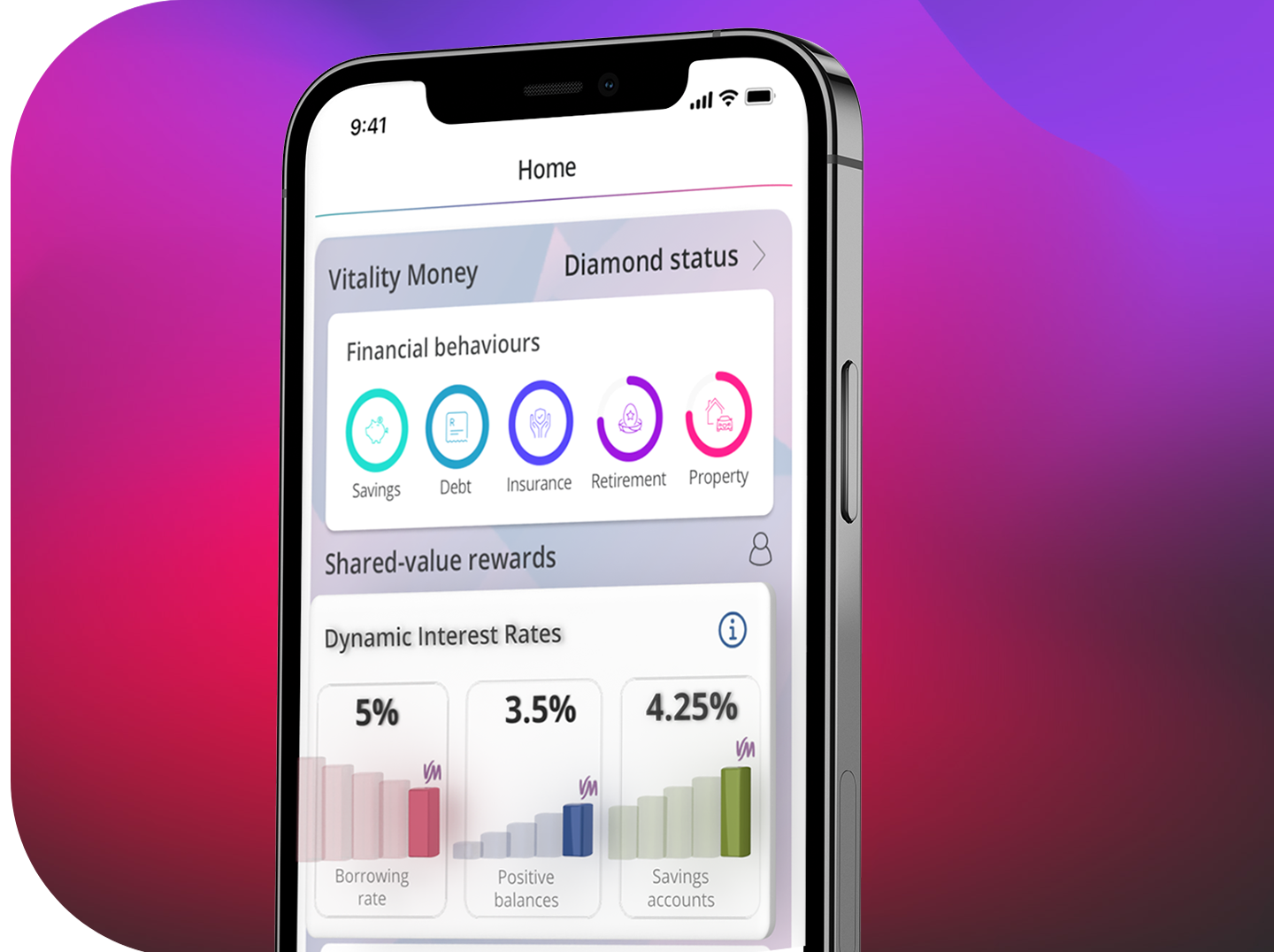

Get rewarded with Vitality Money and Discovery Bank

Up to 75% back on HealthyFood purchases

Up to 50% back on HealthyCare items

Up to 75% off local and international flights

From 10% to 30% off when spending Discovery Miles at over 40 online and in-store retail partners on Miles Ð-Day

Up to 20% back on Uber rides

Up to 70% back on your fuel purchases at bp and Shell

Fully digital credit applications

Borrow against your Discovery investments

Use your investments with Discovery Invest to get access to additional funds when you need them, through secured credit. You can do this without giving up your investments or paying penalties or taxes. This benefit is exclusive to Discovery Bank Black and Purple Suite accountholders with Discovery Invest investments valued at over R500 000.

You can upgrade to a new Discovery Bank Black or Purple Suite and get credit that is backed by your qualifying Discovery investments.

With our single credit facility, you get to choose how much of your credit to allocate between your credit card and transaction account.

Speak to your financial adviser today for more information.

Exclusive to Discovery Bank Black and Purple Suite clients.

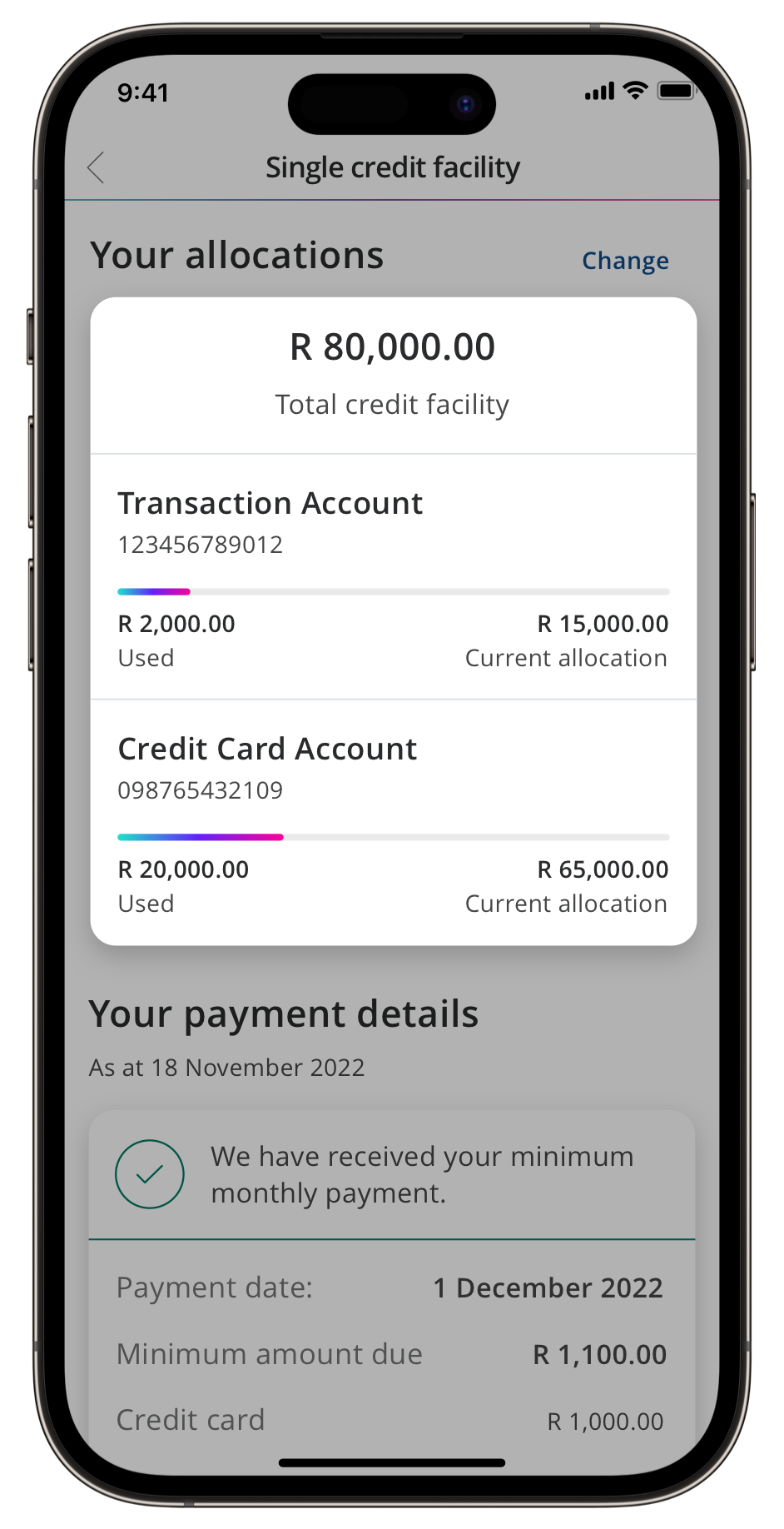

A flexible, single credit facility shared between accounts

We make managing your credit simple and convenient. With our single credit facility, you get one credit agreement for all your day-to-day banking and credit card accounts.

That means if you have a Discovery Bank Suite, you automatically get access to an overdraft on your transaction account, plus the borrowing facility on your credit card account.

One credit agreement means one borrowing rate, with one overall credit limit. This gives you the freedom to choose how to allocate it between your accounts. Had more debit orders this month than expected? Simply shift your available credit from one account to the other in just a few taps on the banking app.

And best of all - all accounts linked to your single credit facility enjoy the same dynamic borrowing rate that you can reduce by up to 7% when you manage your money well with Vitality Money.

Learn moreEasily manage your credit facility in the Discovery Bank app

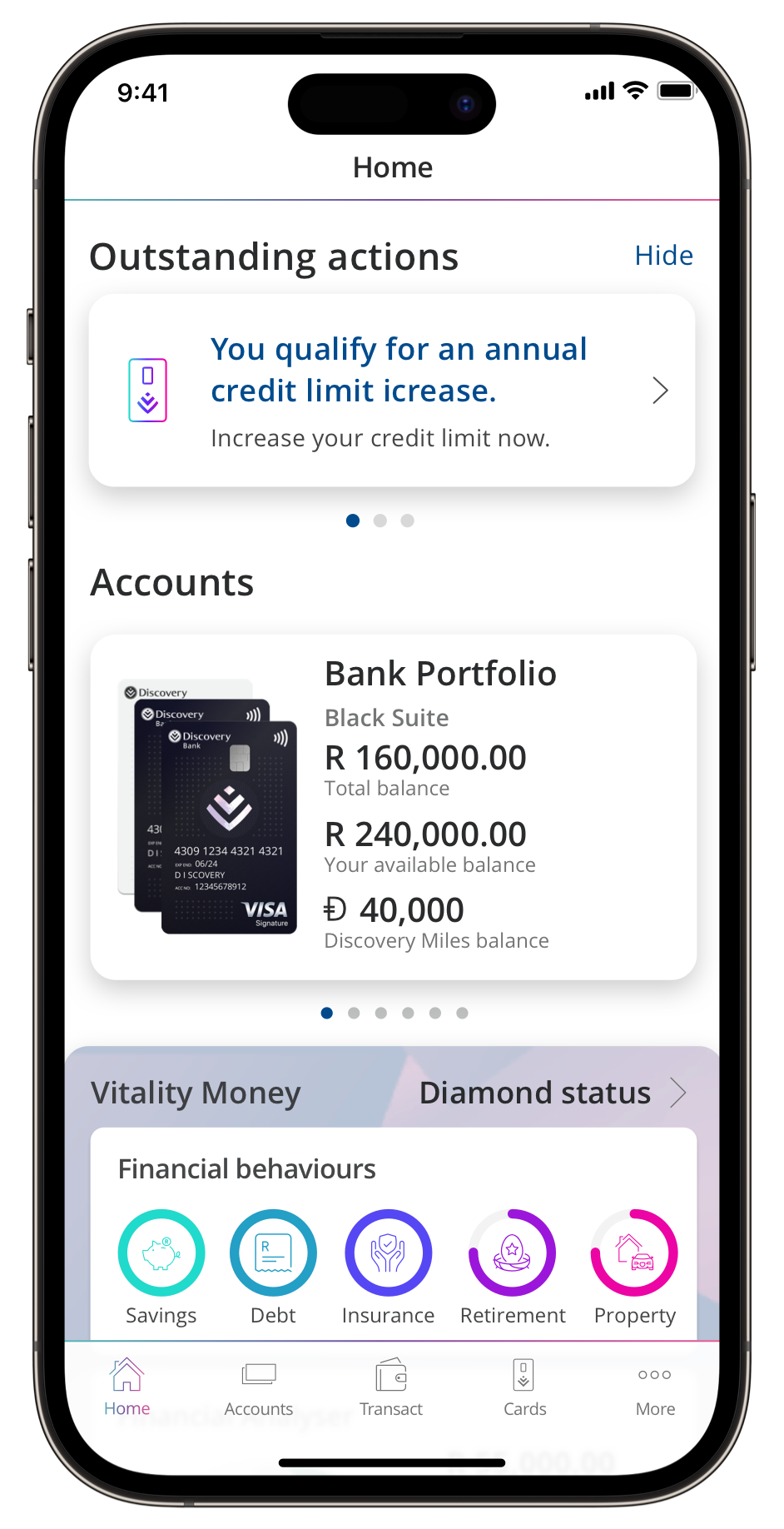

We've enhanced the Discovery Bank app to make it even easier to apply, manage and control your credit.

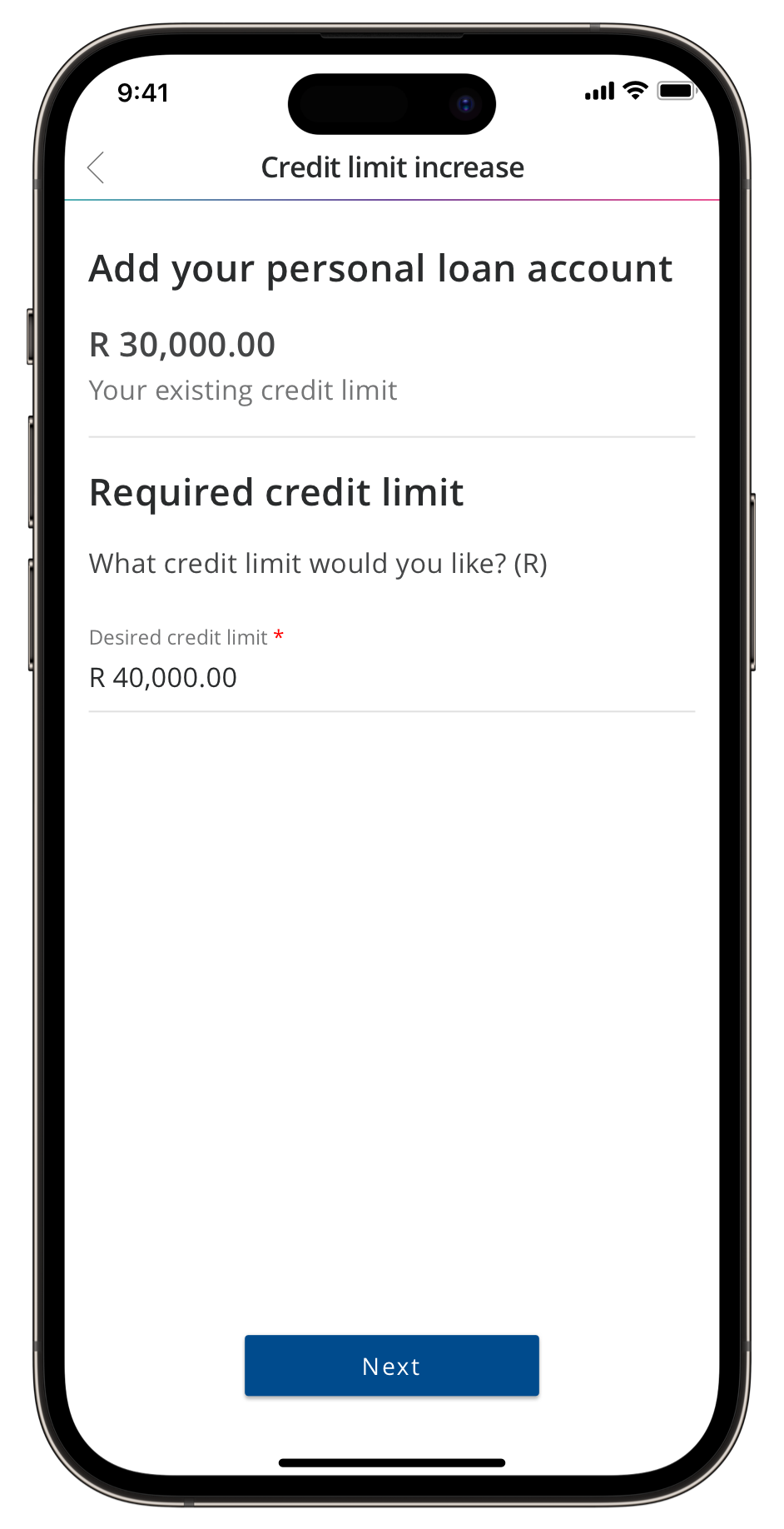

Get automatic annual credit limit increases based on how well you manage your money, without submitting additional documents.

Effortlessly allocate credit across your transaction and credit card accounts, with no additional costs or paperwork.