A uniquely sophisticated banking experience

Up to 75%

Up to 50%

Up to 20%

Up to 7.5%

You'll receive 10 Ðiscovery Miles for every R1 reward you earn back.

You'll receive 10 Ðiscovery Miles for every R1 reward you earn back.

Earn base Ðiscovery Miles on all qualifying credit card and multicurrency debit card purchases as you spend throughout the month. Plus, earn higher base Ðiscovery Miles when you use a virtual card, depending on your Vitality Money status.

Earn thousands of Ðiscovery Miles every week on the new,

personalised gameboard with Vitality Active Rewards

Your goals

Achieve your weekly Spend, Exercise or Drive goal to unlock Activity tiles of up to Ð1,500

Your products

Unlock the Discovery tile of up to Ð750 based on how many Discovery products you have

Your spend

Spend at our grocery, pharmacy and fuel partners to unlock the Partner Spend tiles of up to Ð1,500 for the chance to earn your largest weekly transactions back

Get up to 30% off when you spend your Ðiscovery Miles:

With a Discovery Bank Purple Suite, you could get up to 15% off when you spend your Ðiscovery Miles throughout the month:

You can also:

Save more and pay less with Dynamic Interest Rates

As a Discovery Bank client, you can control your interest rates with your Vitality Money status through Dynamic Interest Rates. With a Discovery Bank Purple Suite, you can get:

Up to 1.6% interest on your positive balances in your everyday accounts.

Up to 6.5% interest on demand savings accounts.

Up to 7% less interest on your borrowing rate.

Get an Apple Watch on us

Get a new Apple Watch from iStore with Discovery Bank and Vitality, and fund it in full by reaching your weekly Vitality Active Rewards Exercise goals over 24 months.

For the discerning traveller

Vitality Travel is the first-of-its-kind, one-stop travel booking platform in South Africa that you get exclusive access to with Discovery Bank.

Enjoy unprecedented discounts on a wide range of local and international flights, holiday accommodation, car hire and exciting travel experiences.

Travel benefits and services

- You can now book your discounted local and international flights in the Discovery Bank app - tap, tap, fly!

- Access to a global concierge service to assist with travel planning, securing entertainment tickets and more

- Free multi-trip international travel insurance with flight tickets purchased using your Discovery Bank Purple cards

- International cover for rental car collision damage

- The ability to make purchases and cash withdrawals worldwide, wherever Visa is accepted

Up to 75%

off local flights

Get 10% to 75% off six one-way local flights with our partner airlines, plus an unlimited 10% off afterwards

Up to 75%

off international flights

Get 10% to 75% off two economy or premium economy class, or one business class bookings for regional or international flights with our partner airlines, plus an unlimited 10% off on economy or premium economy flights afterwards

Up to 25%

off holiday accommodation

and car hire

Get 10% to 25% off unlimited local accommodation and car hire

Plus, use Ðiscovery Miles to pay for thousands of non-discounted local and international listings on Vitality Travel through Booking.com

Up to 15%

back on your next beach holiday, cruise or city adventure

Get up to 15% cash back on Dream Destinations travel experiences with Contiki, Royal Caribbean International and World Leisure Holidays

Enjoy The Lounge, a partnership between Discovery Bank and SAA at OR Tambo, Cape Town, King Shaka and Chief Dawid Stuurman International Airports. Get unlimited* domestic departure and international departure visits a year for you and your guests.

You'll also receive unlimited access to over 1,200 airport lounges worldwide with DragonPass.

Plus, get faster security clearance with Discovery Bank Priority Fast Track at OR Tambo and Cape Town domestic departures, and at OR Tambo International arrivals passport control.

*If you have an average monthly spend of at least R22,500 per month, effective 1 January 2025. Otherwise you will receive complimentary access for 2 domestic visits and 1 international visit.

Love the comforts of your own home? You can also choose to use the Purple home technology benefit instead of your international flight benefit. Get up to 50% off premium Apple or Technogym purchases to transform your home office, cinema or gym.

To access the Purple home technology purchase benefit, or to keep enjoying your exclusive international business class flight benefit, you must maintain an average monthly positive balance of at least R250,000 across all your qualifying accounts.

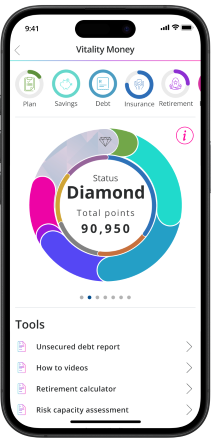

Improve your finances with Vitality Money

When you join Discovery Bank, we help you review your financial health based on six key financial behaviours and you get a Vitality Money status based on this. Your Vitality Money status gives you a good indication of how well you are managing your finances.

Not only that, but your Vitality Money status is also directly linked to what rewards you can earn. That's why we'll show you the steps to improve your status and give you access to tools like our Vitality Money Financial Analyser, which uses advanced analytics to give you intelligent insights and personalised alerts to help you become better with your money. As your Vitality Money status improves, so do your rewards.

More on Vitality Money

Improve your Vitality Money status with wealth points

You can earn between 20 000 and 80 000 wealth points if you have R5 million or more in savings and investments. This means that, with a significant amount of investible assets, you could reach Gold Vitality Money status in no time.

Get the only Real-Time Forex Accounts

You can quickly and easily open our Discovery Bank Forex Accounts, available in British Pounds, Euros and US Dollars, 24/7 on the Discovery Bank app.

Get real-time rates and immediately start saving and transacting in the foreign currency of your choice. Plus, you pay no fees when you transfer and convert between your foreign currency and Rand accounts, and we'll help you manage your foreign currency allowances too!

Add your free virtual card on the banking app and link it to your smart device for fast on-the-go payments while you travel outside South Africa or order a physical debit card for cash withdrawals abroad.

Plus, as a valued Discovery Bank Purple Suite client, you pay no monthly fees for your forex accounts.

Open. Convert. Save. Pay. In seconds.

What features to expect with your Discovery Bank Purple Suite

World-class service

- A relationship banker for a truly personalised banking experience

- Access to Discovery Purple Servicing - an exclusive channel to help you with your rewards, banking products and any other Discovery Group products

- Access to a dedicated Discovery Purple Concierge team, equipped with contacts and resources to help you secure last-minute gifts, travel arrangements, dinner reservations and so much more.

An advanced and intuitive banking app

- Add more or upgrade your accounts

- Manage your cards, PINs and limits

- Check your account balances

- Track and improve your dynamic lifestyle rewards

- View your Dynamic Interest Rates

- Transfer funds between accounts

- Manage and spend your Ðiscovery Miles

- Make international payments in over 60 currencies

- Track foreign currency allowances

- Set up beneficiaries

- Set up debit orders

- Increase credit limits

- View and export transaction history

- Use Smart Search to find transactions

- Save important receipts and documents with Smart Vault

- Make online payments and EFTs

- Get immediate in-app help from a Discovery Banker with Live Assist

- And much more!

Comprehensive banking benefits

- A transaction account for managing your day-to-day banking needs and a credit card account with up to 55 days of interest-free purchases on select credit card transactions

- Up to 50 free Discovery Bank virtual cards to start using immediately after joining

- A single credit facility to split between your credit card and overdraft as you like

- Get an effective borrowing rate of up to prime -1%

- Access secured credit from R250,000 to R5 million with your qualifying investments with Discovery Invest

- Save and transact in US Dollars, British Pounds and Euros with your complimentary Real-Time Forex Accounts

- Instantly settle medical co-payments at pharmacies like Clicks and Dis-Chem, hospitals and medical service providers with Health Pay

- Make on-the-go payments with Apple Pay, Fitbit Pay, Garmin Pay, Google Pay, Samsung Pay and SwatchPAY!

- Pay any of your contacts who are Discovery clients, using just their cellphone number

- Withdraw cash at a till point at Checkers, Pick n Pay, Shoprite and selected Spar stores

- Make deposits at Boxer, Checkers, Pick n Pay and Shoprite stores

- Get free transaction notifications and monthly account statements

- Choose from a range of unlimited, free savings account options, with personalised interest rates for large deposits

- Access a range of Vitality Money tools to help you manage and improve your financial health

- 30 free real-time payments using Discovery Instant Pay or PayShap to other South African banks, available 24/7

- Automatic CODI deposit cover of up to R100,000 per depositor in case of a bank failure and its liquidation.

Enhanced security features

- Advanced facial-recognition technology when logging in to the banking app

- Discovery Bank Purple cards use secure chip and PIN technology

- Your card can make fast and secure tap-and-go payments

- Secure tap-and-go payments with smart devices that support Apple Pay, Fitbit Pay, Garmin Pay, Google Pay, Samsung Pay and SwatchPAY!

- Additional security with Verified by Visa and Visa Checkout for online purchases

- Greater shopping convenience and security when shopping online with Discovery Bank virtual cards.

A Ðiscovery Miles Account

- View, track, manage and spend your Ðiscovery Miles

- Generate vouchers for in-store payments

- Purchase airtime, data, prepaid water, prepaid electricity or digital vouchers

- Exchange your Ðiscovery Miles for cash

- Send Ðiscovery Miles to your contacts.

Banking fees for the Discovery Bank Purple Suite

With a Discovery Bank Purple Suite you have a monthly fee of R679 and an annual card fee of R4,000. Your monthly fee includes your monthly account fee, your Vitality Money premium, your single credit facility fee, most transaction fees and more. After that, you transact and only pay for what you use. For more details on your banking fees, please see the fees guide.

Rewards are based on your engagement in Vitality programmes, Discovery products, and monthly qualifying card spend. Discovery Bank, Auth FSP. Limits, terms and conditions apply.